IAB UK: podcast ad market grows 8% in the UK; video grows 20%

The UK’s digital ad market surpassed £35bn in spend last year, growing by 13% - a far faster rate than overall GDP which stood at 1.1% - according to IAB UK’s latest Digital Adspend report, conducted with MediaSense.

The data shows that advertisers doubled down on the content-rich possibilities offered by video display ads - spanning social channels, publishers, outstream, AVOD and BVOD - with 64% of all online display spend now invested in video, up from 51% five years ago.

This acceleration in advertisers’ video spend correlates with audiences’ behaviour. All age groups under 55 years are spending more hours per week watching digital video vs linear TV, according to GWI (1), providing advertisers with a powerful opportunity to capture consumers’ attention where they are spending their time.

When it comes to device, Adspend shows that mobile formats attracted the bulk of video investment - growing 20% to £6.1bn - but spend on connected TVs (2) grew at a stronger rate for the first time, rising by 22% as advertisers embrace digital video across screens.

Despite the majority of growth coming from display formats, search maintained its market dominance - making up 47% of all digital ad spend in 2024 and up by a healthy 13% year-on-year to hit £16.6bn.

Other key findings include:

- Total market growth was consistent throughout the year with H1 and H2 both showing a 13% growth rate - indicating that uncertainty caused by the Autumn budget didn’t immediately impact advertisers’ confidence

- Spend on digital retail media grew by 23% to a total of £1.4bn - giving it a 4% share of the UK’s total digital ad market

- The gaming ad market grew by 9% to £1.1bn as gaming audiences continue to diversify - more women than men are now playing across mobile, tablet and laptops according to Ipsos iris (3)

- IAB UK forecasts that total digital ad spend will grow 7% in 2025 to reach £38bn, although prolonged global economic uncertainty following the introduction of tariffs could impact this

- Looking further ahead, total spend is expected to reach £42.4bn by 2027, with investment in video display predicted to account for 27% of the market, vs 23% in 2024 (4)

Podcasting

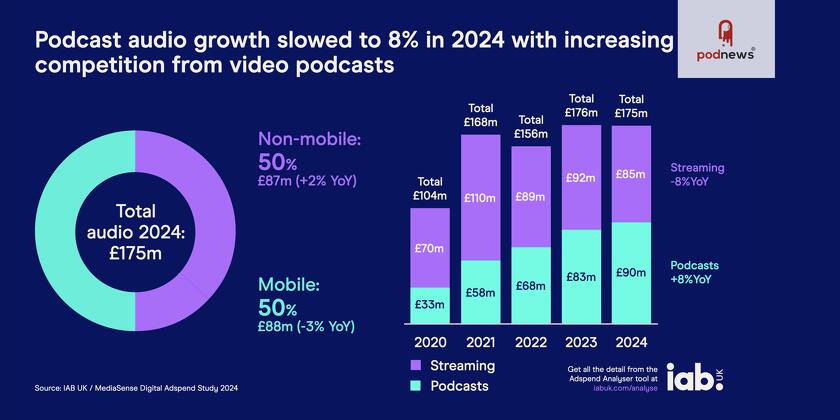

- Podcast spend in the UK reached £90m in 2024, with YoY growth of 8%. This is a slow down on 2023 when annual growth stood at 23%

- The above just accounts for audio podcast ads; the video display category, including video podcast ads, grew strongly, up 20% to £8.3bn

Commenting on the results of Digital Adspend, Jon Mew, CEO of IAB UK, said: “Whether you’re watching a podcast on your phone or streaming YouTube on the TV, how we consume media is becoming increasingly video-centric and that’s shaping where advertisers are investing budgets. This isn’t just about aligning with engaging content. Digital video ads give brands the creative canvas to create brilliant content themselves and deliver those essential brand building moments. We expect to see advertisers’ shift to video accelerate over the coming years as new technology diversifies our screen choices and barriers between different media channels continue to erode.”

Sources

Source: GWI, 80k UK respondents aged 16+, 2020 & 2024 Measured as a device i.e. TVs that are connected to the internet (see ‘Notes to Editors’ for more) Source: Ipsos iris, ' Exploring Digital: Mobile Gaming’, June 2024 All forecasts based on current IAB UK/MediaSense Digital Adspend data + statistical modelling

This is a press release which we link to from Podnews, our daily newsletter about podcasting and on-demand. We may make small edits for editorial reasons.